The past week has been packed with exciting developments in the D2C home fragrance industry, from major brand collaborations to major product launches. Research powered by Loup Marketing - request a personalized sample report for your brand.

🔥 Key Trends & Takeaways:

1️⃣ Bath & Body Works Goes Royal with Disney Princess Collection

📅 Reported: February 11, 2025

Bath & Body Works launched its largest-ever collection in collaboration with Disney, featuring 85 all-new products inspired by six Disney Princesses.

The Disney Princess Collection includes fragrance mists, body care, and three-wick candles, blending nostalgia with self-care products.

Loyalty members received early access on February 11–12, ahead of the official launch to all customers on February 16.

💡 Why It Matters:

Leverage Nostalgia & IP: Partnering with a beloved franchise like Disney taps into deep emotional connections and drives store traffic.

Exclusive Early Access Drives Engagement: Rewarding loyalty members with early access encourages repeat purchases and strengthens brand advocacy.

2️⃣ NEST New York Partners with HBO’s The White Lotus

📅 Reported: February 3, 2025

NEST New York launched a limited-edition candle inspired by HBO’s The White Lotus ahead of the show’s Season 3 premiere.

The White Lotus x NEST candle (Cucumber & White Sage, $98) is designed to evoke a luxurious spa resort ambiance, aligning with the show’s Thailand setting.

The fragrance blends cucumber, white sage, and lavender, promoting a de-stressing and refreshing experience.

💡 Why It Matters:

Pop Culture Tie-Ins Expand Reach: Collaborating with a trending TV show taps into an engaged audience, driving media attention and organic buzz.

Experiential Positioning Strengthens Brand Identity: Selling an experience rather than just a scent helps create deeper consumer connections.

3️⃣ Give Back Beauty (GBB) Acquires AB Parfums

📅 Reported: February 3, 2025

GBB acquired Italian fragrance manufacturer AB Parfums, known for managing licensed perfumes for Ralph Lauren, Maison Margiela, Diesel, Azzaro, and Viktor & Rolf.

The acquisition strengthens GBB’s direct-to-retail distribution in key European markets like Italy, Germany, and Spain.

This move is part of a larger trend of consolidation in the fragrance industry, where major players seek to scale operations and expand their global reach.

💡 Why It Matters:

Distribution is a Competitive Advantage: A strong retail network is just as crucial as product quality for scaling in the fragrance industry.

Investment Confidence in Fragrance: With ongoing acquisitions, home fragrance brands should consider positioning themselves as attractive acquisition targets for larger firms.

📊 Financial & Market Trends:

📈 Fragrance Market Stays Hot in 2025

📅 Reported: February 8, 2025

Fragrance sales in the U.S. hit $8.8 billion in 2024, marking a 22.1% YoY growth.

Both brick-and-mortar and online sales saw similar growth rates (~22%), while unit sales rose nearly 12%, signaling increased consumer demand.

Prestige fragrances saw double-digit gains, fueled by social media influence (e.g., #PerfumeTok) and growing interest in home fragrance as a self-care ritual.

💡 Why It Matters:

High Consumer Engagement in Fragrance: Brands should double down on fragrance marketing, whether through influencer collaborations, seasonal collections, or digital sampling.

Omnichannel Strategies Are Key: Consumers are shopping both online and in stores—brands need to offer seamless experiences across both channels.

🚀 What This Means for Marketers:

Brand collaborations with pop culture and nostalgia-driven themes continue to be powerful tools for engagement.

Retail distribution and direct-to-consumer growth remain critical levers for home fragrance brands.

The fragrance market is seeing sustained momentum—offering opportunities for brands to invest in innovation and omnichannel strategies.

🔹 Advertising Strategies by Brand

1️⃣ Discount & Promotion-Heavy Strategies

Bath & Body Works and Yankee Candle rely on frequent sales-driven ads, such as BOGO offers and limited-time discounts to push volume and urgency.

Byredo and Boy Smells also leverage discounts in targeted campaigns, signaling that even premium brands use promotions selectively to drive conversions.

Byredo: Gift your loved ones with lipstick that adds a touch of allure to their smile, making every day extraordinary. Enjoy a complimentary full-size lipstick of your choice with orders $170+.

2️⃣ Influencer & UGC (User-Generated Content)

Otherland and Homesick focus on micro-influencers and organic content, turning social media creators into brand advocates. Their strategy avoids aggressive paid ads, instead amplifying real customer experiences to build trust.

Glade ran a holiday influencer campaign, blending DIY workshops and organic creator content to generate seasonal buzz.

3️⃣ Luxury & Prestige Branding

Diptyque and Jo Malone London position themselves as aspirational brands through minimalist, high-end storytelling ads, avoiding direct discounts and instead focusing on the artistry behind their fragrances.

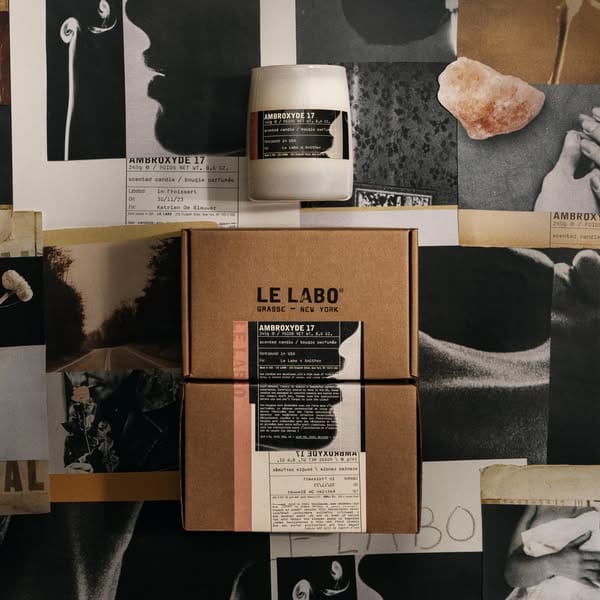

Le Labo maintains an “anti-advertising” approach, using poetic and mysterious messaging to enhance brand mystique and exclusivity.

4️⃣ Tech-Driven Personalization

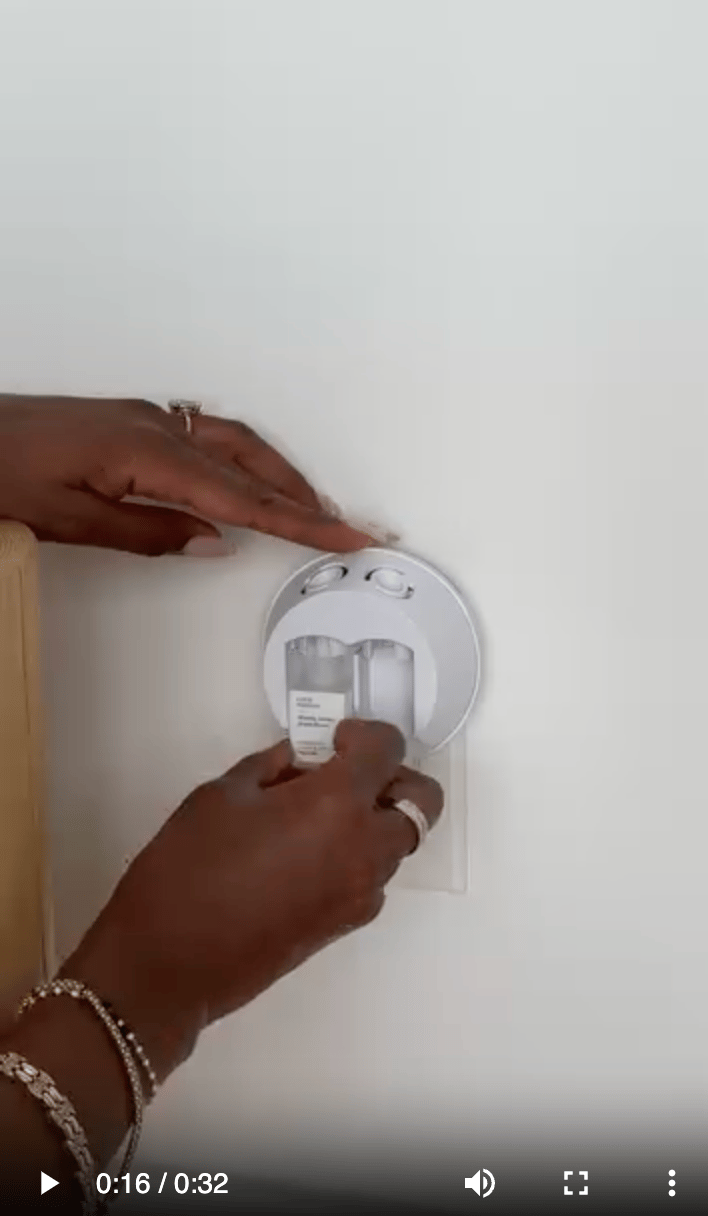

Pura differentiates through smart home fragrance technology, using video ads to showcase app-controlled diffusers and customizable scent experiences.

Screenshot of the education video.

Yankee Candle integrates digital tools like scent quizzes to personalize shopping, bridging traditional retail with modern online engagement.

📌 Key Takeaway:

Promotions drive conversions for mass-market brands like Bath & Body Works, while luxury brands rely on brand mystique and storytelling to maintain exclusivity.

Influencer-driven campaigns are crucial for DTC brands like Otherland and Homesick, leveraging authenticity over paid ads.

Tech integration is emerging in home fragrance marketing, with brands like Pura using customization features to enhance consumer engagement.

🔹 Ad Formats: Video, Image, or Carousel?

Video is king: Pura and Glade use video ads to demonstrate smart features and lifestyle moments.

Image ads dominate discounts: Yankee Candle and Bath & Body Works rely on static images for promotional offers.

Carousel ads highlight variety: Nest and Jo Malone London use carousel ads to showcase different product formats in a single campaign.

📌 Key Takeaway for Ad Formats:

Video ads drive engagement for experience-focused brands like Pura and Glade, showcasing smart features and storytelling.

Static image ads excel at promotions and urgency, used by Yankee Candle and Bath & Body Works for discounts and seasonal sales.

Carousel ads work best for product variety, with Nest and Jo Malone London highlighting full fragrance collections.

💡 Video engages, images convert, and carousels educate. 🚀

💯 Top-Performing Organic Posts

Analyzing engagement rates, virality and user sentiment, we’ve picked a few best-performing organic posts examples:

Le Labo EUCALYPTUS 20 Launch (7,756 total engagement)

Date: February 3, 2025

Likes: 7,695 | Comments: 61

Strategy: Product Launch Teaser

New fragrance announcement with minimalist product focus

Diptyque Lifestyle (6,846 total engagement)

Date: February 2, 2025

Likes: 6,818 | Comments: 28

Strategy: Lifestyle & Aspirational Imagery

Cozy breakfast scene featuring candles in use

Le Labo EUCALYPTUS 20 Ingredients (6,126 total engagement)

Date: February 5, 2025

Likes: 6,086 | Comments: 40

Strategy: Product Feature Post

Deconstructed view of fragrance ingredients

Common Themes:

✔ Early Morning Dominance - All top posts consistently published at 6:00 AM, establishing the optimal engagement window for luxury fragrance brands.

✔ Sustained Campaign Success - Le Labo's EUCALYPTUS 20 launch secured multiple top spots through strategic multi-day content rollout, proving the effectiveness of coordinated product launches.

✔ Visual Storytelling Power - High-performing posts utilized either ingredient deconstruction (Le Labo) or lifestyle integration (Diptyque), showing the impact of educational and aspirational content.

✔ Brand Consistency - Two luxury brands (Le Labo and Diptyque) dominated through distinct but unwavering content approaches, demonstrating the importance of clear brand identity in social strategy.