The new year will be packed with exciting developments in the D2C haircare industry. Research powered by Brand Radar - start tracking your competitors.

Happy New Year, everyone.

We’ve officially survived Q4. And if you’ve been watching the numbers, you know it was a weird one. Consumer confidence is… shaky. The “blind buy” is dead. Shoppers aren’t merely looking for pretty packaging anymore; they want receipts (clinical ones) and real value.

While some brands are still reeling from shipping delays or trying to offload stagnant holiday stock, a few smart players used the Dec/Jan window to launch campaigns that built strong habits while moving units.

Here are five specific campaigns from the last month that rewrite the playbook for early 2026.

🏆 The Five Ad Campaigns that Crushed It

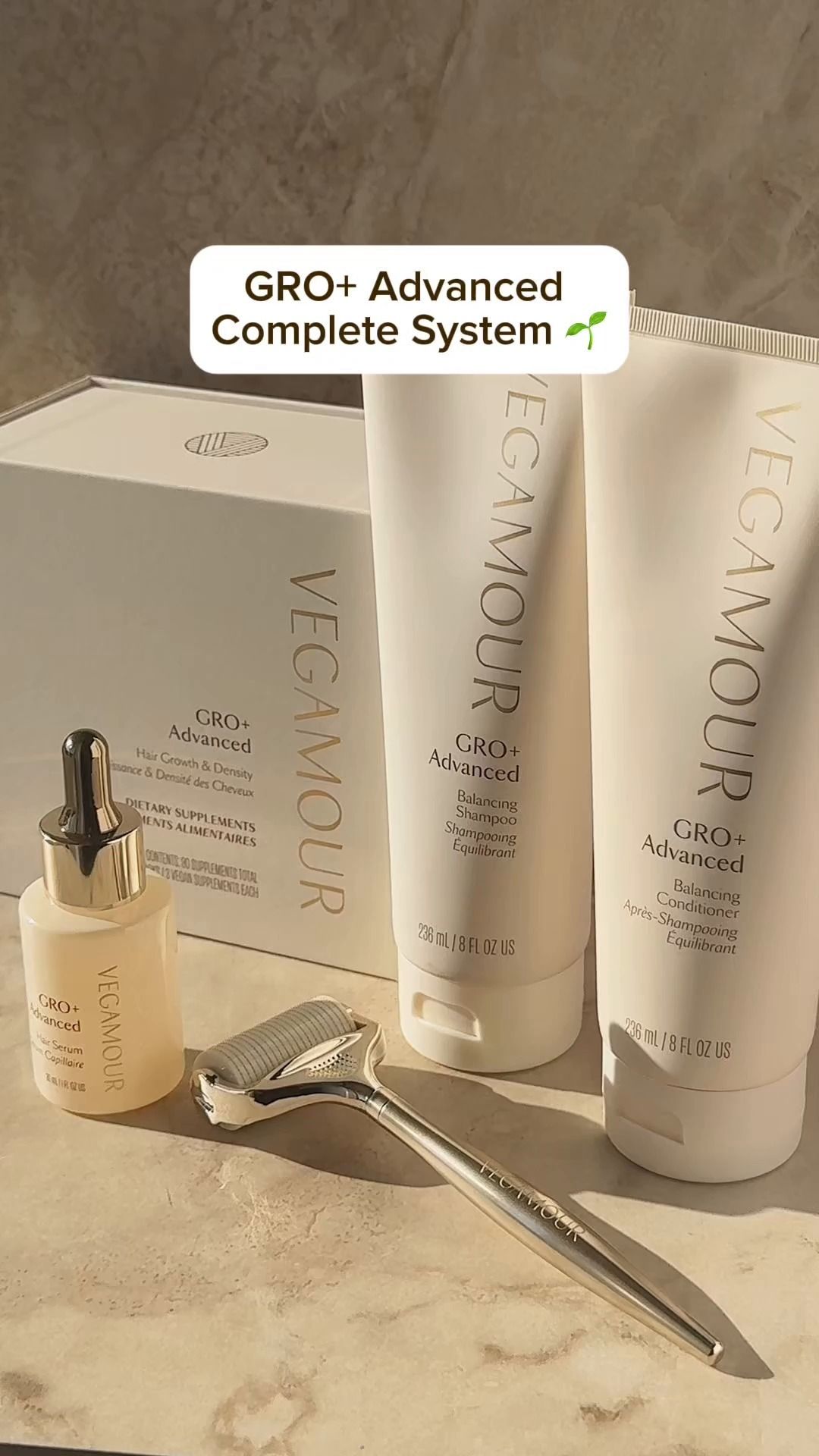

#1 The "Resolution" Pivot: Vegamour’s Hair Growth Challenge

Most brands treat January as a clearance bin. Not so with Vegamour. Instead of a standard “New Year Sale,” they launched the “2026 Hair Growth Challenge.”

The Hook: They leveraged the psychology of New Year’s resolutions, reframing a 3-month product supply as a “commitment to self.”

Why It Worked: It shifted the conversation from vanity to wellness/recovery. By using emotional testimonials (chemo recovery, postpartum), they tapped into a deeper vein than standard beauty marketing. This is how you lock in LTV (Lifetime Value) before Q1 even really starts.

#2 The "Smart" Bundle: Amika’s Travel-Ready Sets

Gift sets are standard Q4 fare, but Amika nailed the logic of the bundle with sets like “Positively Perked Up.”

The Hook: Pairing a full-size dry shampoo with a travel-size one.

Why It Worked: It solved a specific friction point for the post-pandemic, travel-hungry consumer: "One for my bathroom, one for my carry-on." It’s a simple merchandising tweak that drove perceived value without needing to slash prices. Plus, their packaging remains unmatched for “thumb-stopping” power on TikTok.

#3 The Subscription Grab: Prose’s 60% Off Offer

While competitors like Function of Beauty struggled with operational hiccups, Prose went on the offensive with a massive acquisition push: 60% off the first order + free gifts for new subscribers.

The Hook: A classic loss-leader strategy executed across a broad range of ads.

Why It Worked: In an economy where shoppers are budget-conscious, a deep discount is the only way to get them to switch loyalty. Prose is betting big on their product quality to retain these users long-term. It signals confidence: "We’ll pay to get you in the door because we know you won’t want to leave."

#4 Winter Escapism: Ouai’s St. Barts Takeover

Selling body cream in winter is easy. Selling a vacation is art. Ouai leaned hard into their St. Barts scent line (Body Crème & Mist) right when the weather turned bleak.

The Hook: Sensory escapism. “Vacation in a bottle.”

Why It Worked: They successfully expanded their “share of bathroom” beyond haircare. By marketing a mood rather than just hydration, they turned a commodity product into an emotional necessity. It’s a masterclass in “scent-scaping” a brand.

#5 The "Anti-Tech" Viral Loop: Kitsch’s Heatless Curls

Sometimes the best technology is… no technology. Kitsch continued to dominate the conversation by owning the “de-influencing” / low-maintenance trend.

The Hook: Zero damage, zero effort styling.

Why It Worked: They capitalized on the “skinification” trend (protecting hair health) by offering a mechanical solution to heat damage. The product is inherently shareable—the “reveal” video is TikTok gold. Frequent stockouts only added to the hype, proving that in 2026, analog innovation can beat high-tech tools.

Need a complete view of your market?

We provide a daily-updated comprehensive industry research dashboard - customizable to the brands you want to track!

Get Your Free Trial📊 Financial Trends:

The Numbers Behind the Noise

The divergence between "legacy" giants and "agile" disruptors became starker in the financials this period.

The Disruptor Growth: Kitsch is putting up numbers that are hard to ignore. In November 2025 alone, their online sales revenue hit $19.4M, significantly outperforming the industry median. They are seeing 50% year-over-year post-purchase revenue growth, proving that the "accessory-first" model is a viable path to dominating the haircare conversation.

The Customization Winner: Prose has solidified its lead in the custom category, hitting $165M in revenue and opening a new customization hub on the West Coast to speed up delivery times—a crucial move to fix the logistics issues that plague the custom sector.

The Macro View: The giants are feeling the "consumer caution." P&G flagged softer sales in Q2, citing US market volatility. Meanwhile, Unilever’s Prestige Beauty division (home to Living Proof and K18) managed mid-single-digit growth, buoyed largely by the "skinification" and wellness trends driving brands like Nutrafol.

📈 Year in Review

The transition from late 2025 into early 2026 represents a watershed moment for the global haircare economy. As the industry hurtles toward a projected market valuation of USD 82.5 billion in 2026, the underlying mechanics of consumer engagement, brand loyalty, and value perception have fundamentally shifted. The period under review—December 2025 through January 2026—was a stress test for brand equity in an environment defined by macroeconomic caution and rapidly evolving aesthetic standards.

Here’s to a profitable Q1!

Try it out for yourself

Our AI radar reveals the winning strategies and costly mistakes from your competition's ad campaigns.

See Brand Radar In Action